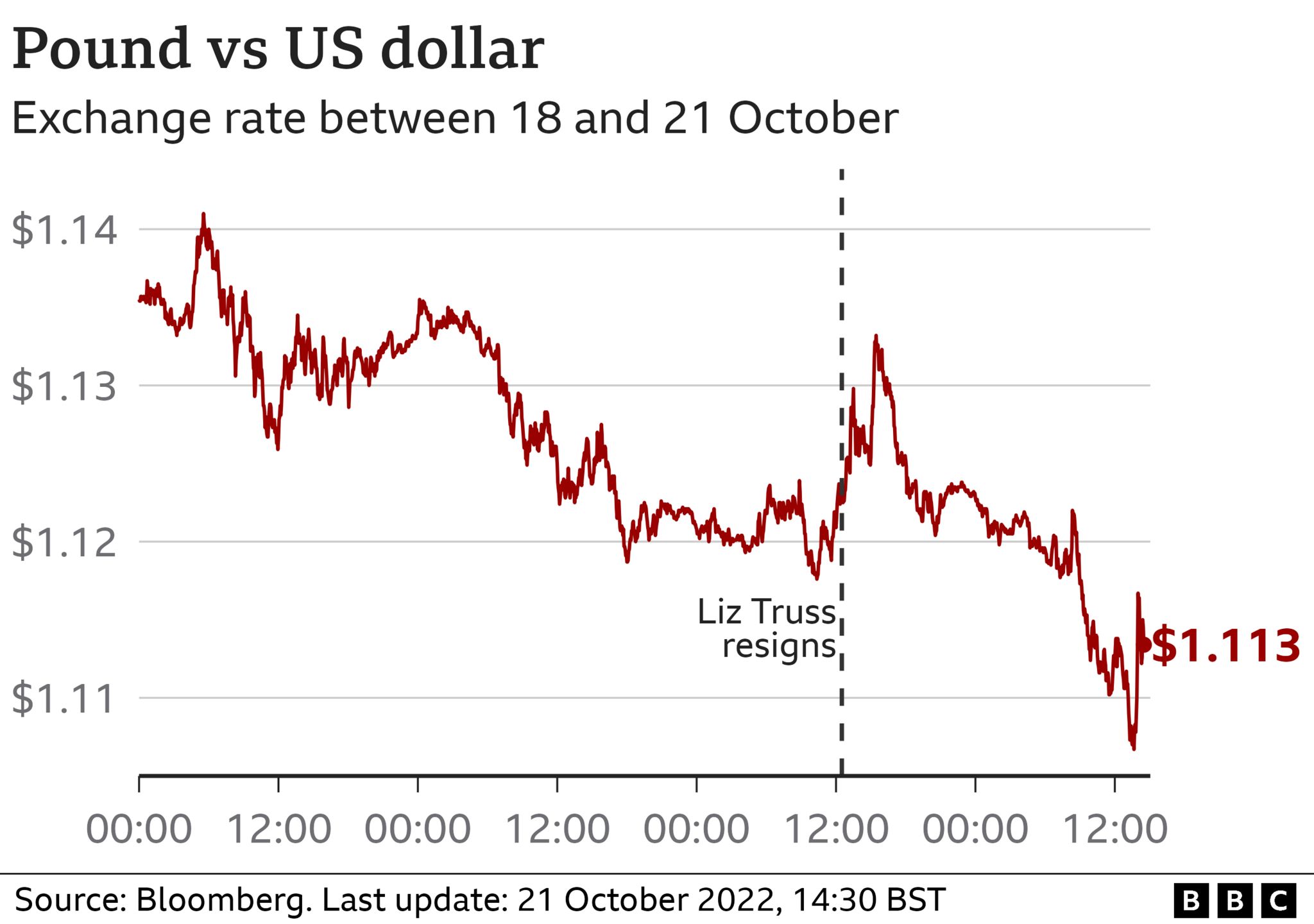

The pound fell against the dollar on Friday as new figures showed a gloomy picture for the UK economy.

Sterling slipped to $1.11, after rallying on Thursday as Prime Minister Liz Truss resigned.

However, it clawed back losses on Friday evening and was back up to around $1.12 against the dollar.

The volatility in the pound came after official figures showed government borrowing rose to its second highest September on record.

Meanwhile, people are shopping less than they did before the coronavirus pandemic, according to figures from the Office For National Statistics (ONS).

Retail sales fell by more than expected last month, dropping 1.4% and continuing their slide from August, the official figures showed.

The pound’s latest slide comes after a period of volatile trading for the currency.

It plunged to a record low against the dollar last month, while government borrowing costs rose sharply in the aftermath of the mini-budget. Investors were spooked after the government promised huge tax cuts without saying how it would pay for them.

Government borrowing costs also rose slightly on Friday.

A fall in the US dollar against a number of currencies late Friday helped the pound regain some ground.

But Jane Foley, a currency strategist at Rabobank, said much of the pound’s moves are being driven by investors reacting to political and economic uncertainty in the UK as well as the negative economic data.

“While sterling rallied yesterday on Truss’s resignation, I think investors have realised today that it’s not a guarantee that we’ll get a market-friendly outcome from the Conservative leadership contest,” she said.

The Chancellor, Jeremy Hunt is due to announce plans for spending and tax on 31 October in his economic plan, which the Treasury confirmed was set to go ahead, although there are reports it could be delayed due to the leadership race.

Ms Foley said this uncertainty was also weighing on the pound.

“The longer the uncertainty continues, the worse it’s going to be for the markets.”

Why does a falling pound matter?

A fall in the value of the pound increases the price of goods and services imported into the UK from overseas – because when the pound is weak against the dollar or euro, for example, it costs more for companies in the UK to buy things such as food, raw materials or parts from abroad.

A weaker pound can push rising costs higher as well if companies choose to pass on higher prices to customers. For people planning a trip overseas, changes in the pound affect how far their money will go abroad.

Najib Mikati promises justice for Irish UN peacekeeper killed in Lebanon

Lebanon is determined to uncover the circumstances that led to the killing of an Irish UN peacekeeper, caretaker prime minister Najib Mikati said during a visit to the headquarters of the UN Interim Force in Lebanon (Unifil) on Friday. Private Sean Rooney, 23, was...

US appeals court says lawsuit against Lebanese bank can proceed

A US court of appeals has ruled that cases against Lebanese commercial banks can be tried outside Lebanon, paving the way for more cases by depositors seeking to unlock their frozen funds. The court decision, issued on Thursday in a case brought by Lebanese depositors...

2023 Hyundai Elantra Hybrid will surprise you (review)

We are living in the age of cynicism, when everyone seems jaded, as if nothing surprises us anymore. So, when something does deliver more than you’d expect, it’s a genuine delight. Such is the case with 2023 Hyundai Elantra Hybrid Limited compact sedan, starting...

Submit your event

We will be happy to share your events. Please email us the details and pictures at publish@profilenewsohio.com

Address

P.O. Box: 311001 Independance, Ohio, 44131

Call Us

+1 (216) 269 3272

Email Us

Publish@profilenewsohio.com