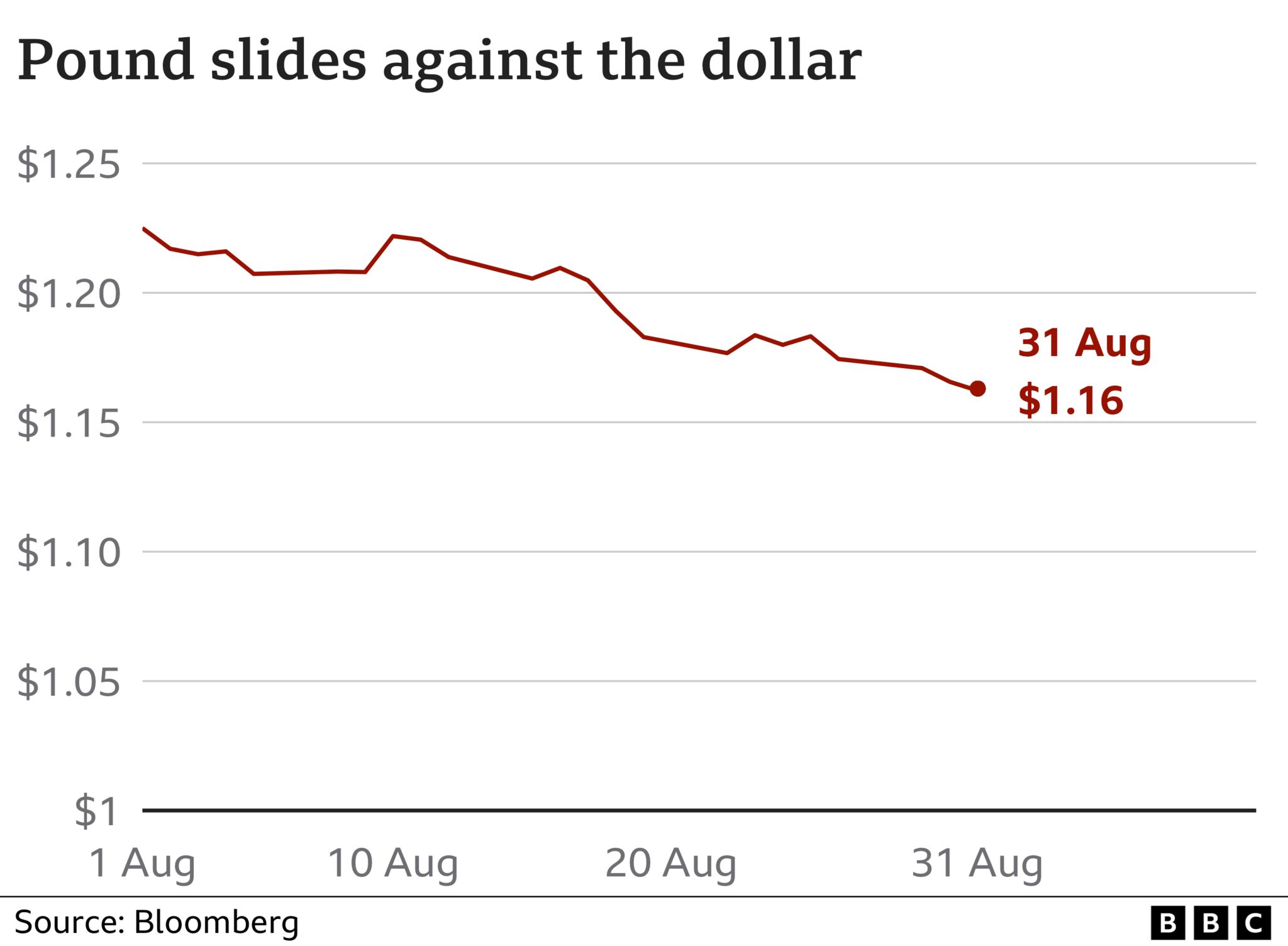

Worries over the prospects for the UK economy led the pound to slide by about 5% against the US dollar in August.

The last time the pound fell so much against the dollar was in October 2016, in the aftermath of the Brexit vote.

Sterling sank again on Thursday morning, dipping below $1.16 on the currency markets.

Analysts said the fall reflects the darkening outlook for the economy, with consumers and businesses facing rising prices and soaring energy bills.

The Bank of England has predicted the UK will fall into recession towards the end of this year.

The weak pound means Brits travelling overseas will find their spending money will not stretch as far.

“Our economic prospects are not looking particularly good compared to the rest of the world,” said Laura Lambie, senior investment director at Investec.

Ms Lambie said that recession fears were weighing on markets, with the investment bank Goldman Sachs warning this week that the UK could remain in recession until 2024.

A recession is defined as the economy getting smaller for two consecutive three-month periods.

August was also the worst month for the pound against the euro since the middle of last year.

UK government bonds – or debt – had their worst month for decades. Investors, worried about the riskiness of lending to the government, demanded higher returns for doing so, making it more expensive for the country to borrow money. In August, the yields, or the effective interest rate you would get, on some of those bonds have jumped the most since 1994.

Colin Ellis from ratings agency Moody’s told the news Today programme the jump in yields needed to be put in context. “Energy bills are very very high, and set to go up again. which means inflation is going to be high and that the Bank of England is raising interest rates in response.

“Those expectations for higher interest rates are part of what’s driving these moves in the bond market at the moment.”

However, he said: “We still have a stable outlook on our UK government rating so we see the risk as broadly balanced. We’re not very concerned but of course a lot will depend on the policies that the next government chooses to put into place.”

‘Torrid month’

Fears have grown over the prospects for the UK economy after figures showed it shrank between April and June, with businesses and households feeling the impact of rising prices.

Those concerns were fuelled on Thursday, with a new study suggesting the manufacturing sector shrank in August for the first time since May 2020.

Separately, a report by the Resolution Foundation think tank said typical household disposable incomes are on course to fall by 10%, or £3,000, over this year and next, which is called the “the deepest living standards squeeze in a century”.

The cost-of-living crisis is set to be the biggest challenge facing the new Prime Minister.

Both Rishi Sunak and Liz Truss have come under pressure to outline how they would support households if they succeed in getting the keys to Number 10.

”Grim forecasts about poverty spreading across the UK this winter highlight the deepening woes for the UK economy”, said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

The Bank of England raised interest rates to 1.75% in August, while forecasting that the UK economy would fall into recession this year.

But Ms Streeter predicts that the Bank of England might be forced to slow down rate rises in the coming months, given the cost of living crisis.

Dollar strength

The pound’s weakness is also a result of a strong dollar, analysts said.

The dollar is performing strongly due to US interest rate rises and because investors see it as a safer bet.

Last week, the head of the country’s central bank, the Federal Reserve, indicated it would push ahead with further interest rate rises as it seeks to control inflation.

“The dollar has been exceptionally strong,” Ms Lambie said.

“Also, the issues that we’ve had in Europe around energy do not have the same impact as the US, and I think economists are fairly agreed that the US will be the last to go into recession if they do go into recession at all, perhaps following the UK and Europe.

“So on both sides, from the sterling side and from the dollar side, that’s really what has weakened sterling and strengthened the dollar.”

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/S6ZXZ5ZMYX5T7KZS4RHDGSVFYQ.jpg)

Akron has earmarked all its $145 million in COVID stimulus funds. Here is where it will go: Stimulus Watch

The City of Akron is ahead of many nearby cities, in that it has already approved how it wants to spend its $145 million in American Rescue Plan Act dollars. Though the projects have been approved throughout the last year, city officials gave a presentation detailing...

Apple sued by women over AirTag stalking

Apple is being sued by two women who say AirTags were used to stalk them. The small trackers are designed to be placed on wallets or keys, to prevent them from being lost. However earlier this year that several women had found unwanted AirTags tracking them. Apple...

China rolls back strict Covid rules after protests

China is lifting its most severe Covid policies - including forcing people into quarantine camps - just a week after landmark protests against the strict controls. People with Covid can now isolate at home rather than in state facilities if they have mild or no...

Meta threatens to remove US news content if new law passes

Meta has threatened to remove news content from Facebook in the US. It objects to a new law that would give news organisations greater power to negotiate fees for content shared on Facebook. A similar law, passed in Australia, led to news on Facebook being briefly...

Bank Morgan Stanley to cut 1,600 jobs

Bank Morgan Stanley is cutting about 1,600 jobs or roughly 2% of its global workforce, joining other big banks in making reductions as the economy slows. The news comes after chief executive James Gorman warned that the bank would see "modest" job losses. He cast the...

Civil groups file request for EU and US sanctions on corrupt Lebanese leaders

A Swiss foundation and a Lebanese NGO on Monday sought to pressure western countries into imposing sanctions on Lebanese leaders by filing legal petitions at the US Treasury and two European Union bodies, three years into the small Mediterranean country's worst-ever...

Submit your event

We will be happy to share your events. Please email us the details and pictures at publish@profilenewsohio.com

Address

P.O. Box: 311001 Independance, Ohio, 44131

Call Us

+1 (216) 269 3272

Email Us

Publish@profilenewsohio.com

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/P6BOVJXPT2UDW5FEIXW3KPQJKI.jpg)